- Give advice in disbursement and fees of your own loan amount.

- Provide characteristics into recuperation out of funds started to the platform.

P2P platforms was centered completely on the internet which means that the application process try faster and you may easier and incredibly helpful in terms so you can securing funds quickly. Most of the time brand new P2P systems have a list off buyers would love to render finance toward suitable borrowers hence means that committed of getting the cash regarding individuals normally become extremely swift, perhaps even several hours.

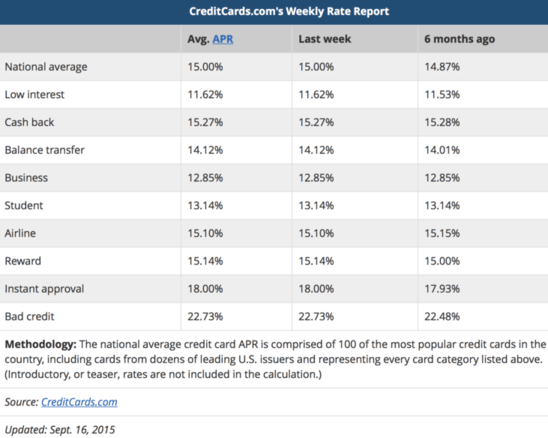

Access to lower prices

Individuals can occasionally have access to financing that have rates of interest that is actually below however if he’s obtained a loan during the a traditional fashion such as for instance away from banking companies and you can building communities. The reason being brand new dealers promote currency to the fresh new individuals because of such systems and hence there is absolutely no part of every intermediary associated with such as for example monetary providers. Consequently, this causes the main benefit of the functions of a great deal more favorable cost.

Zero influence on the credit score on account of choosing the original estimate

Personal loans by way of P2P lending are so simple as well as the credit history is not very impacted due to getting a great customised price. As a result will bring an affordable and better notion of one potential loan.

Having room for another choice for that loan become gotten from traditional lenders

The latest P2P system performs a crucial role into the looking towards those people who pick an alternative means this is the antique approach to meet the monetary need which often produces proper market for consumers.

Transaction out of personal loans and better freedom than simply traditional financing

Due to the fact P2P finance is both secured together with unsecured truth be told there isn’t any compulsion out of taking people safety for protecting the loan such as for example is the case or even. In addition, it implies that the applying procedure stays small and you will uncomplicated, letting you supply money for the a smaller time. At exactly the same time, P2P financing render significantly more independency than other form of fund. For example, from the credit performs, you could make an enthusiastic overpayment if not accept the bill away from the loan any time, no more will cost you inside it. You are able to change your monthly installment date to suit your individual funds, therefore if your own pay check is found on a specific day each month, you could potentially lay the loan cost to occur with the exact same date.

Highest efficiency towards dealers

When compared with other sorts of expenditures, P2P will bring highest output to the investors. P2P finance always feature down interest rates from the higher battle between lenders and lower origination charge. P2P can potentially give you access to significantly highest yields than just you can aquire as a result of a top-street bank account.

Solutions

The person can pick if she or he wants to provide to, according to research by the borrowing character of the borrower.

Chance diversification

Since this platform keeps located access allows the administrative centre be spread across numerous fund which enables it to help you broaden the risks.

The compulsion of passageway a credit check plus one interior see so you can contain the loan

While the importance of old-fashioned financing will not happen into the circumstances where P2P financing has come toward help save, it does Memphis installment loans bad credit not mean that the need for the underwriting procedure is additionally got rid of. Every P2P lending systems require individuals to successfully pass a credit glance at with the intention that the individual is actually creditworthy. Along with the credit assessment new borrower even offers to pass through certain internal monitors. The reason for this might be fairly simple: they is designed to manage the funds out-of people exactly who give fund also to differentiate within of these which standard and people that creditworthy.